The last ten years have seen big changes in marine fuels, even more than the previous seventy years. Post World War II, ships started using Heavy Oil in advanced engines, which was available everywhere and made ships sail faster and more efficiently. This change shifted ships from using Steam Engines to Heavy Fuel Oil and Diesel Engines, which most ships use now.

Global warming has become a major concern for our planet. Governments and environmentalists are insisting industries to reduce Greenhouse Gas (GHG) emissions. Many countries work together in the United Nations to set rules, with the most recent meeting called COP 27 held in November 2022. These meetings set up targets and means to achieve environmental goals. The Maritime Environment and Protection Committee of the IMO, works on setting up guidelines for the maritime industry. At its 80th session held in July 2023, the committee adopted a landmark resolution called MEPC80 to reduce GHG emissions from ships. They set new targets :

- 20% reduction in emissions by 2030

- 70% reduction in emissions by 2040

- Net Zero emissions by 2050

(These targets compare the amount of emissions made by ships in 2008.)

Achieving these objectives presents a colossal challenge for the maritime sector, with Heavy Oil historically gaining favor due to its abundant supply and cost-efficient nature. An entire ecosystem has been developed over the years, whereby ship operators could reliably find bunkers meeting international standards anywhere globally. This also allowed cargo ships to efficiently carry loads with minimal bunkers during long international voyages, thus optimising commercial considerations. Any alternate fuel aspiring to replace Heavy Oil will thus require worldwide availability to enable acceptance.

Currently, over 98% of the world’s cargo fleet relies on Heavy Oil. Nonetheless, signs of a changing scenario are imminent, with approximately 21% of ships currently on order are being built with options to burn alternative fuels. These ships incorporate modern engines designed to use new fuel types or have dual engines capable of burning multiple fuel types. This signifies a quantum shift as more shipowners recognise the benefits of cleaner energy sources. It is expected that within the next five years, orders for ships using alternate fuels will surpass those opting for traditional fuels only.

The race to find cleaner fuel started a while ago when ships planned around reducing their Sulphur Dioxide emissions. The IMO’s 2020 marine fuel regulation was a pivotal step in driving this decision. They mandated capping SOx emissions from ships at 0.5%( down from the previous 3.5%). Despite this significant technical and commercial change, the supply chain for bunkers remains the same. The introduction of a Very Low Sulphur Fuel Oil (VLSFO) provided an alternative form of Heavy Oil, utilising existing bunkering infrastructure. This made it easier for ships to change to new fuels without any big problems. Ship operators either installed scrubbers in engines, or opted for low-sulfur fuels, posing technical and commercial challenges but maintaining existing fuel supply.

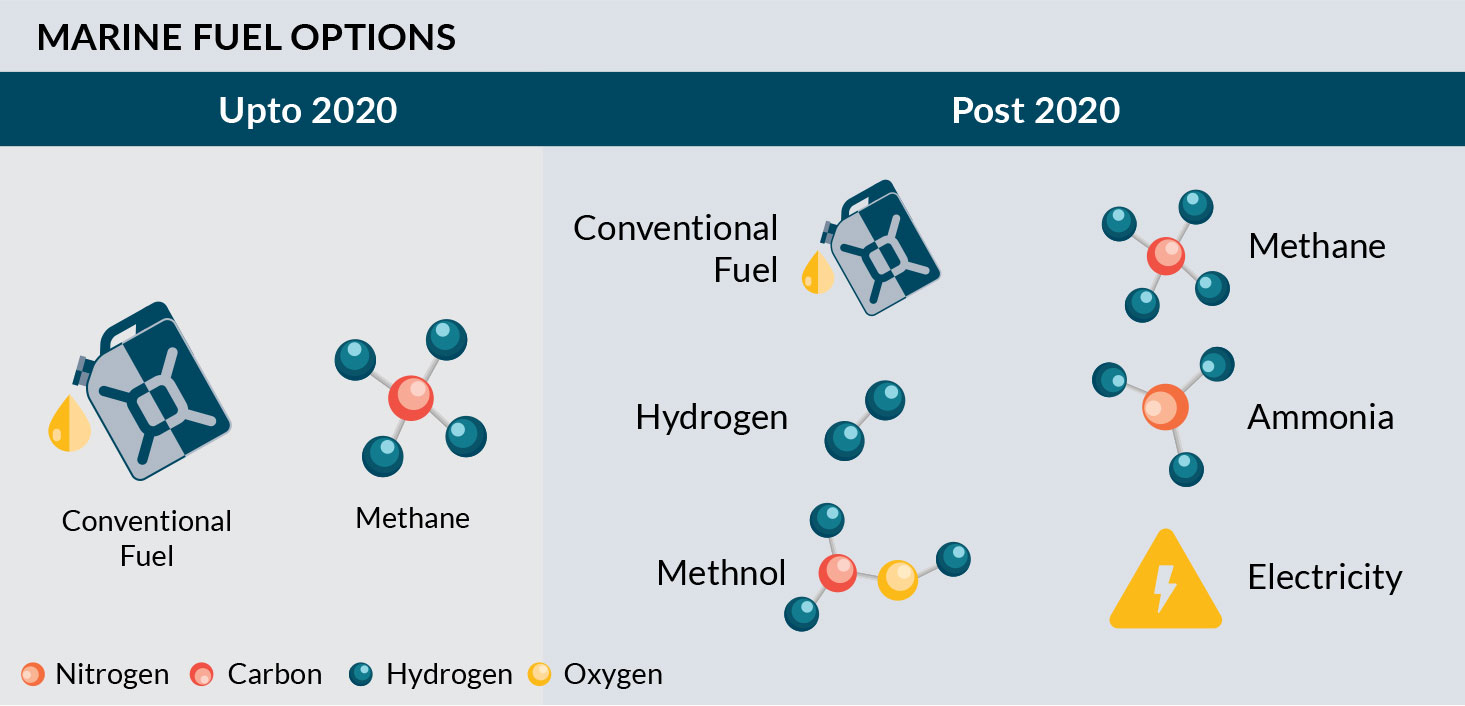

However, the landscape is evolving with the emergence of various new alternative fuels. Setting the supply infrastructure for these new fuels, however, poses a substantial task for the maritime sector. Until recently, commercial ships primarily relied on two types of bunkers - Heavy Oil/Very Low Sulphur Oil and LNG. However, ongoing efforts have explored new alternatives, offering ships the choice Exploring Green Ship Fuels In The MaritimeExploring Green Ship Fuels In The Maritime Industry For A Greener EarthIndustry For A Greener Earth July - September 2023 Newsletter Issue XLII5 Marine Services between conventional fuel, LNG, Hydrogen, Ammonia, Methanol, or even Electricity.

The use of Liquefied Natural Gas (LNG) as bunker fuel has gained prominence, particularly among LNG ships/carriers, and has witnessed increased adoption among other ship types in the past decade. Notably, LNG’s availability along major trade routes and the increase of bunkering facilities and vessels contribute to it’s popularity. A snapshot of LNG’s status as a bunker fuel reveals:

- 426 operational non-LNG carrier ships using LNG as fuel

- 536 ships under construction planning to use LNG as fuel

- 114 ports worldwide providing LNG bunkers

- 34 LNG bunkering vessels available globally

While LNG stands out as a cleaner alternative to Heavy Oil, it remains a fossil fuel. While debates regarding the search for alternative fuel with zero carbon emissions rather than settling for lower emissions still carry on, research continues into new alternatives, leading to the emergence of options such as Hydrogen, Ammonia and Methanol.

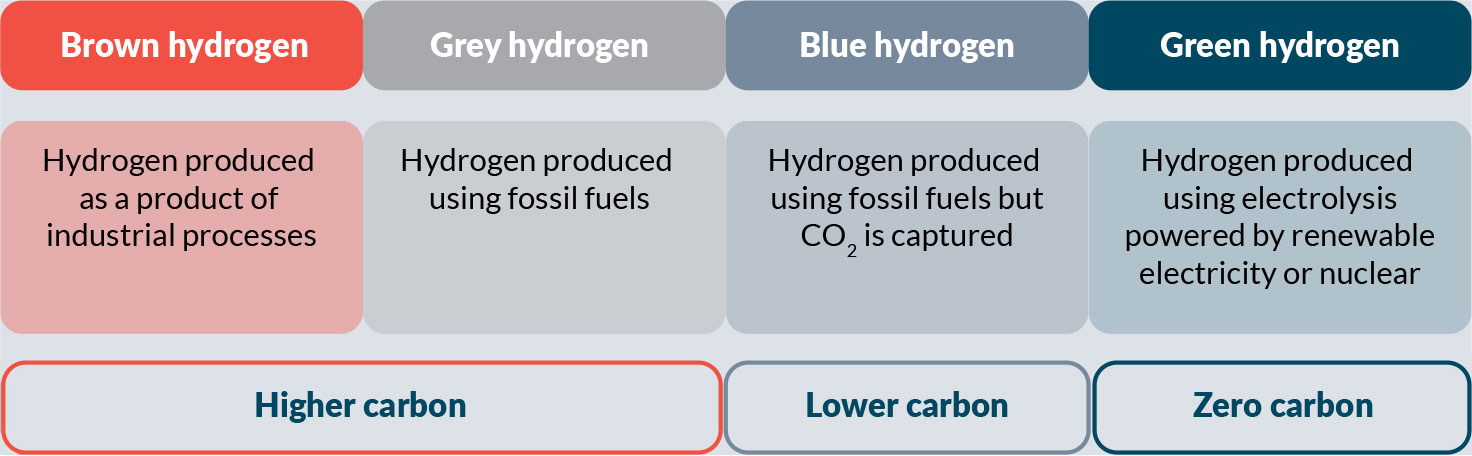

Hydrogen emerges as the best alternative due to its emission-free nature, with only water as a byproduct. In India the government has come up with a policy document and is encouraging companies to set up establishments for supply of Hydrogen to various industries and various geographies. However, challenges concerning Hydrogen storage and supply, along with varying methods and sources, categorize Hydrogen as green, blue, grey, or brown. Achieving access to Green Hydrogen remains the ultimate goal, though this transition is anticipated to take several years.

Similarly, there are multiple projects exploring Ammonia and Methanol as future ship fuels. While both have multiple advantages, commercial viability and availability to the global merchant fleet will require substantial time. At present, no commercial ships operate using Hydrogen, Ammonia or Methanol. Nonetheless, experimental voyages and studies have shown that these alternate fuels can replace Heavy Oil in the future. The enthusiastic engagement of the global maritime industry in these studies fuels rapid progress, indicating the shifting tides in the world of ship bunkers. However laying out the entire supply chain for these fuels for a global industry like shipping implies at least a couple of decades. Until then, Very Low Sulfur Fuel Oil (VLSFO) and LNG will remain the preferred bunker fuels.

India has a very active maritime trade with its 200 plus ports witnessing over 40,000 ship calls annually. Although not yet a top-tier bunkering hub, India’s geographic location provides an opportunity to emerge as a bunkering hub for LNG. With its strategic positioning along international trade routes and a steady supply of LNG, India could potentially establish itself as a LNG bunkering hub for ships. Existing LNG import terminals and upcoming Floating Storage and Regasification Units (FSRU) facilities could be developed into such hubs in the country. A successful LNG bunkering operation was conducted at the port of Cochin in 2017, demonstrating its technical feasibility.

As the largest Agency house in India, the J M Baxi group is gearing up to provide bunkering solutions to the ships of the future. The group is involved in the transition to cleaner fuel alternatives by ships and would be part of the development of infrastructure whenever bunkering requirements for cleaner fuels would emerge in India. J M Baxi has been successfully handling LNG ships in India for many years. It was part of the first LNG imports to the country at the Port of Dahej and continues to handle such ships regularly at Dahej and few other ports in India. As part of its other decarbonisation exercise, J M Baxi continues to explore options for setting up clean fuel bunkering facilities in India. Whenever successful, this would be another of J M Baxi’s contributions to a cleaner and greener planet.